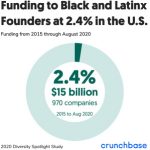

Venture capital gets less diverse in 2020

Welcome back to The TechCrunch Exchange, a weekly startups-and-markets newsletter. It’s broadly based on the daily column that appears on Extra Crunch, but free, and made for your weekend reading. You can subscribe here. First, a big congrats on making it through the week. If you live in the United States, you just endured one of the wildest news weeks ever. Rapid-fire headlines and nigh-panic have been our lot since last Friday when the president announced he was COVID-19 positive....