Inside fintech startup Upstart’s IPO filing

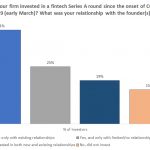

While the world awaits the Airbnb IPO filing that could come as early as next week, Upstart dropped its own S-1 filing. The fintech startup facilitates loans between consumers and partner banks, an operation that attracted around $144 million in capital prior to its IPO. First Round Capital, Khosla Ventures, Third Point Ventures, Rakuten and The Progressive Corporation led rounds in the startup, according to Crunchbase data. There’s quite a lot to like in Upstart’s IPO filing, including rapidly...