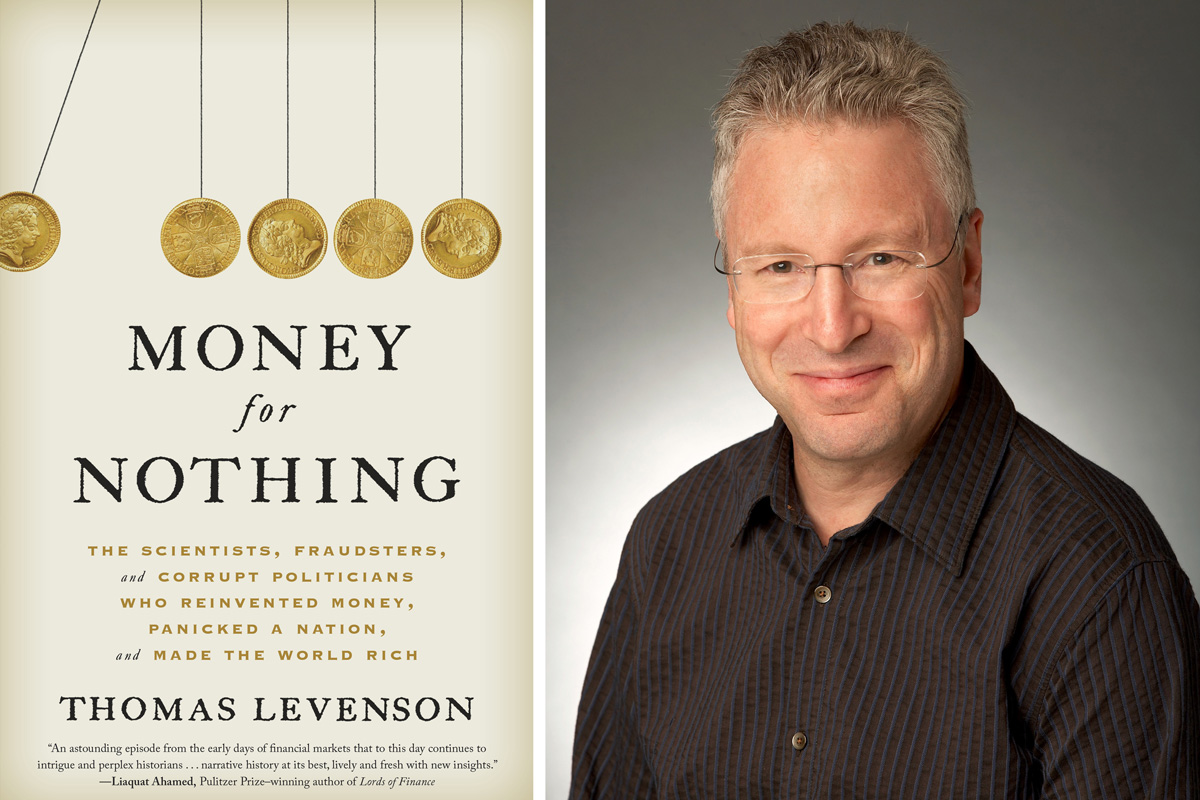

The subprime mortgage-bond meltdown. The dot-com boom. The Enron fiasco. The last couple of decades have seen their share of finance absurdities and scandals, but such episodes are hardly new. Indeed the most important of them all may be the South Sea Bubble, in which Britain’s South Sea Company floated shares based on the promise of future trade while assuming Britain’s national debt, but then collapsed in 1720, ruining many investors. And yet, as MIT Professor Thomas Levenson explains in a new book — “Money for Nothing: The Scientists, Fraudsters,…